January 10, 2026 | By Admin

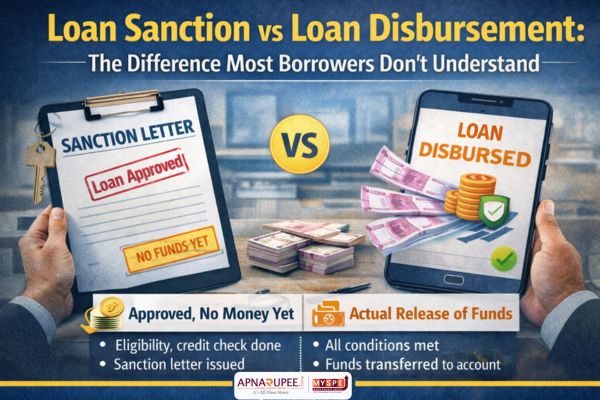

Loan Sanction vs Loan Disbursement

Many borrowers celebrate when their loan gets sanctioned. In reality, that’s only half the journey. A large number of loan delays and cancellations happen after sanction but before disbursement—and borrowers are often unsure why.

Understanding this difference can save you time, stress, and last-minute surprises.

What Is Loan Sanction?

Loan sanction means the lender has approved your loan in principle after checking:

-

Your eligibility

-

Credit score

-

Income and documents

At this stage, the bank issues a sanction letter mentioning:

-

Approved loan amount

-

Interest rate

-

Tenure

-

Terms and conditions

Important: No money is released yet.

What Is Loan Disbursement?

Loan disbursement is the actual release of funds to:

-

Your bank account, or

-

The seller/builder (in case of home loans)

Disbursement happens only after all conditions in the sanction letter are fulfilled.

Why Do Loans Get Stuck After Sanction?

This is where most confusion happens.

Common reasons include:

-

Pending property or legal verification

-

Incomplete documentation

-

Delay in agreement signing

-

Insurance or margin amount not paid

-

Changes in income or credit score

Even a small delay can push disbursement by weeks.

Sanction Letter Conditions You Should Read Carefully

Most borrowers skip this—but it matters.

Pay attention to:

-

Validity period of the sanction

-

Pre-disbursement conditions

-

Required own contribution (margin money)

-

Interest rate change clauses

Missing the validity window may require re-approval.

How Apnarupee Ensures Smooth Disbursement

At Apnarupee Fin India Pvt. Ltd., our role doesn’t end at sanction.

We help with:

-

Tracking sanction validity

-

Coordinating with banks and legal teams

-

Completing documentation on time

-

Ensuring quick and hassle-free disbursement

Our focus is simple: approved loan + timely money in hand.

Final Thought

A sanctioned loan is a promise.

A disbursed loan is a reality.

Knowing the difference helps you plan better and avoid last-minute pressure—especially for home purchases or business needs.

If your loan is sanctioned but disbursement is delayed, getting clarity early can make all the difference.